Feeling stressed about your finances? You’re not alone! This guide features 25 simple money moves that can help you take control of your spending, save more, and ultimately ease that paycheck panic. Whether you’re looking to cut costs, boost savings, or build better habits, these tips are straightforward and easy to implement for anyone looking to improve their financial situation.

Reviewing Insurance Policies

Insurance can often feel like a necessary evil. It’s something we pay for but may not fully understand. However, taking the time to review your insurance policies can save you money and provide peace of mind.

The image shows someone sitting at a table, surrounded by papers and a calculator, which hints at a thoughtful review process. With a cup of coffee by their side, it seems they are ready to dive deep into the details.

Start by checking what type of coverage you currently have. Are you over-insured or under-insured? This will help you identify where cuts can be made, or if you need to adjust your coverage for better protection.

Next, compare your current policy with other options in the market. Sometimes, simply switching providers can lead to significant savings. Don’t hesitate to ask your agent about discounts you might qualify for.

Lastly, keep in mind that life changes can affect your insurance needs. Whether it’s a new job, a move, or a growing family, make sure your policies reflect your current situation. Regular reviews are key to ensuring you’re not paying too much.

Establishing a Budgeting System

Creating a budgeting system is a key step in managing your finances. The image shows someone focused on their laptop, analyzing their budget through clear graphs and numbers. This scene reflects the importance of visualizing where your money goes.

A budget helps you understand your spending habits. It allows you to track income and expenses effectively. With the right tools, like budgeting software or spreadsheets, you can easily categorize your spending, from groceries to entertainment.

Start by listing your monthly income and fixed expenses. Then, allocate funds for variable costs. This method gives you a clearer picture of your financial situation. The charts on the screen in the image reveal trends and help highlight areas where you might save.

Regularly updating your budget ensures you stay on track. As you adjust your spending, you’ll see where you can cut back or where you might have some room to splurge. The act of budgeting isn’t just about restrictions; it’s about making informed decisions that lead to financial freedom.

Tracking Your Expenses Effectively

In the journey to financial stability, tracking your expenses is a key step. The image here shows a smartphone displaying various graphs and charts that represent spending habits and budget analysis. This visual aid can help you understand where your money is going each month.

The app on the phone highlights the total expenses and income, making it easier to spot trends over time. For example, you can quickly see if you’re spending more than you earn, which is a crucial insight for anyone trying to manage their finances better.

Using such tools helps you break down your spending into categories. Whether it’s groceries, entertainment, or bills, having this information at your fingertips can guide better decision-making. Plus, seeing your finances visually can motivate you to stick to a budget.

By dedicating a few minutes each week to review your expenses through an app like the one shown, you’ll find it’s easier to tweak your habits. This small change can lead to a more secure financial future, reducing that paycheck panic we all dread.

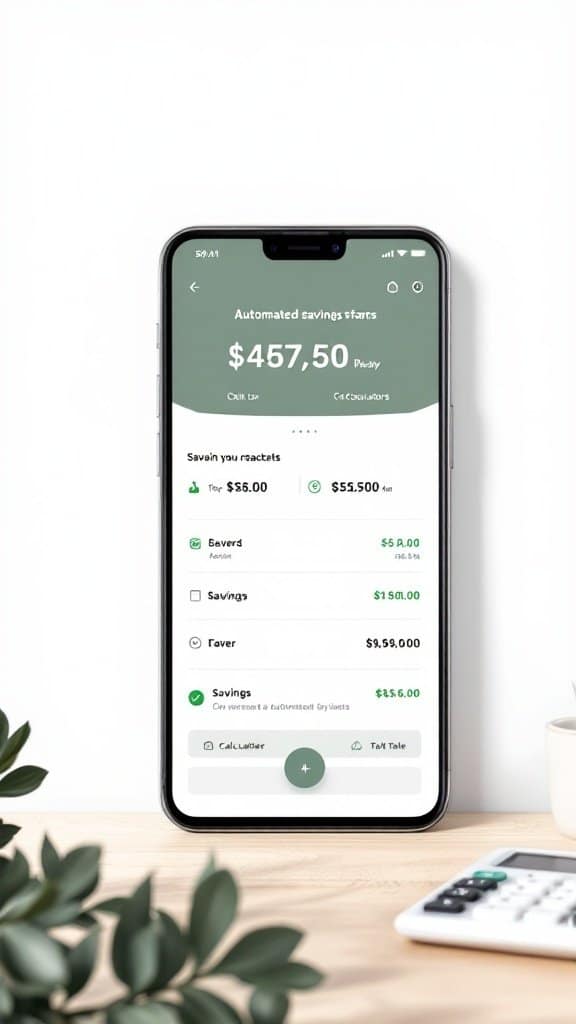

Automating Your Savings

Automating your savings is a smart way to take control of your finances. The image shows a smartphone displaying a savings app, which illustrates how easy it is to manage your money on the go. With a balance of $457.50, it highlights how even small amounts can add up over time.

In the app, you can see various categories like ‘Savings’ and ‘Faver’ with specific amounts allocated to each. This makes it clear how automation can help you set aside money for different goals without needing to think about it every month.

By automating your savings, funds are transferred automatically to your savings account. This means you won’t be tempted to spend what you want to save. Just like setting a reminder to water your plants, you can set up a recurring transfer to grow your savings effortlessly.

So, whether you want to save for a vacation, a new gadget, or even a rainy day, automation can help make it happen. The key is to start small and gradually increase your savings as you get comfortable. After all, every little bit counts!

Setting Up an Emergency Fund

Picture this: a cute pink piggy bank sitting proudly surrounded by coins and cash. This image perfectly represents the idea of saving money for a rainy day. An emergency fund is your financial safety net, helping you avoid stress when unexpected costs pop up.

Why is having this fund so important? Well, life can throw some surprises at us. From car repairs to medical bills, these costs can add up quickly. By setting aside a little cash regularly, you can cushion the blow and keep your finances on track.

So, how do you get started? First, decide how much you want to save. A common goal is three to six months’ worth of expenses. Next, set up a dedicated savings account. This keeps your emergency fund separate from daily spending money.

Remember, even small amounts add up over time. You might start with just a few dollars each week. As you watch your savings grow, it’ll motivate you to keep going. Your piggy bank will thank you!

Exploring Side Hustle Opportunities

In today’s world, finding ways to boost your income is more important than ever. The image captures someone deeply focused on their laptop while working in a cozy café setting. The warm lighting and lush greenery create an inviting atmosphere to brainstorm and get things done. This scene perfectly represents the side hustle culture, where individuals explore different avenues for making extra cash.

Side hustles offer a flexible way to earn additional money while pursuing your passions or skills. Whether you’re freelancing, selling crafts online, or driving for a ride-share service, the possibilities are endless. The laptop in the image signifies the online opportunities available, which can often be started with just a few hours per week.

Imagine sitting in a spot like this, sipping your favorite drink while typing away on exciting projects. It’s all about finding something that resonates with you. Try to explore options based on your hobbies or expertise. Maybe you love writing, photography, or crafting—there’s a side gig out there for you!

Remember, every little bit counts. Even small earnings can help ease financial stress and bring a sense of security. So, take inspiration from this image, find your side hustle, and start your journey towards financial freedom!

Cutting Unnecessary Subscriptions

In today’s world, subscriptions can add up quickly. The image shows someone thoughtfully checking off services they no longer need. This simple act can lead to significant savings.

What do you really use? Take a moment to look through your subscriptions. This list is your roadmap to financial clarity. Examine each service and ask yourself if it still serves a purpose in your life.

It’s easy to forget about recurring payments, especially for streaming platforms or magazines. Each month, these charges can sneak into your account without you even noticing. By keeping a checklist, like the one in the image, you can stay organized and focused on what you actually want to keep.

Cutting unnecessary subscriptions is a straightforward way to ease financial stress. Think of it as decluttering your budget. Once you pinpoint which services are just taking up space, you can free up funds for things that truly matter. So grab a pen, make that list, and start checking off those services!

Negotiating Bills and Expenses

In today’s world, negotiating bills and expenses can feel a bit daunting, but it’s a crucial step in managing your finances. The image shows a young woman on the phone, likely discussing important matters. Her smile suggests confidence and positivity, two key traits to have when negotiating your bills.

Imagine sitting down with your bills and feeling overwhelmed. Instead of panicking, take a breath. You can reach out to your service providers to ask for discounts or better rates. Many companies have programs for loyal customers, and it never hurts to ask for them.

It’s also helpful to do your research before making that call. Knowing what others pay for similar services can give you leverage. Don’t be shy about explaining your situation or mentioning that you’ve found lower rates elsewhere. Companies value customers who communicate openly.

Using this friendly approach can lead to unexpected savings. Your financial health is important, and every little bit counts. So, channel that positive energy like the woman in the image, and tackle those bills head-on!

Utilizing Cashback and Reward Programs

In today’s world, maximizing our spending power is essential. The image here captures a cashback credit card sitting atop receipts, representing the potential to earn money back on everyday purchases.

Cashback and reward programs are like a little bonus for spending you’re already doing. When you use a cashback card for groceries, gas, or even online shopping, you can earn back a percentage of what you spend. This is a straightforward way to keep more cash in your pocket.

It’s important to choose a card that fits your lifestyle. Some cards offer higher cashback rates on certain categories, like dining or travel. By aligning your spending with the right card, you get more out of every dollar.

Take a moment to explore the options available. Many programs also offer sign-up bonuses, which can give your savings a nice boost right off the bat. Just remember to pay off your balance each month to avoid interest charges that could offset your rewards.

Alongside cashback, there are other reward programs that allow you to earn points for travel, gift cards, or even merchandise. If you enjoy traveling, consider a card that offers travel rewards. This way, your everyday expenses can help fund your next getaway.

Evaluating Your Housing Situation

In today’s world, evaluating your housing situation is more important than ever. The image shows someone analyzing financial data on a laptop, which is a huge step towards understanding your living expenses. By looking at graphs and charts, you can get a clearer picture of how much you’re spending on housing.

Housing costs often take up a big chunk of our budgets. It’s essential to track these expenses to avoid feeling overwhelmed each month. This can help you identify if it’s time to consider downsizing or even moving to a more affordable area. Sometimes, making changes to where you live can significantly reduce financial stress.

Using tools and resources, like budgeting apps or spreadsheets, can make this process much easier. As you evaluate your rent or mortgage, think about other related costs, such as utilities and maintenance. This comprehensive view allows you to adjust your finances accordingly.

Additionally, consider if you can negotiate your rent or explore options like roommates. Every small adjustment can lead to big savings over time. Keeping an eye on your housing situation will help you make informed decisions and ultimately ease that paycheck panic.

Creating a Debt Repayment Plan

When it comes to tackling debt, having a clear plan can make all the difference. Take a look at the image of a debt repayment plan board. It’s filled with colorful sticky notes and clear calculations. This visual can motivate you to get started.

The board lists various debts along with their amounts, showing that debt doesn’t have to be overwhelming. By breaking it down into manageable parts, you can take actionable steps. Each sticky note represents a reminder of what needs to be addressed.

Start by listing your debts just like in the image. Write down the total amount you owe, along with any additional fees or commissions. This gives you a clear picture of what you’re facing. The next step is to prioritize these debts based on interest rates or due dates, helping you focus on what to pay off first.

Additionally, make sure to monitor your progress. As you pay off each debt, cross it off your list. This simple act can give you a sense of achievement and keep you motivated. It’s all about taking small steps to reduce your financial stress.

Creating a debt repayment plan is about being proactive. Use visuals like the one in the image to keep your goals in sight. Remember, each small payment is a step closer to financial freedom.

Taking Advantage of Employer Benefits

Taking a closer look at employer benefits can be a smart move when managing your finances. In the image, we see someone reviewing HR documents that outline various benefits. This is a great reminder that there may be valuable resources available to help ease financial stress.

Many companies offer perks that can lead to savings. For instance, health insurance plans often cover a significant portion of medical costs. If you’re not signed up, you could be missing out on considerable savings.

Additionally, some employers provide retirement plans that include matching contributions. This is essentially free money for your future. Make sure to contribute enough to get the full match, as it’s a straightforward way to boost your savings.

Don’t overlook flexible spending accounts (FSAs) or health savings accounts (HSAs). These accounts let you set aside pre-tax money for medical expenses, lowering your taxable income. It’s a win-win for your wallet!

Lastly, take advantage of any educational assistance programs. Many employers will help pay for courses or certifications that can enhance your skills and career prospects. Investing in yourself can pay off in the long run.

Learning to Cook at Home

Cooking at home can be a fun and rewarding way to save money. When you take the time to prepare meals yourself, you can control your ingredients and avoid those expensive takeout options. Plus, it’s a great way to impress friends and family!

In the image, we see someone in a cozy kitchen, carefully adding fresh herbs to a pasta dish. This scene embodies the joy of cooking and the simplicity of making a delicious meal from scratch. The ingredients are colorful and fresh, suggesting a tasty and healthy choice.

Getting started is easy! Gather some basic ingredients like pasta, vegetables, olive oil, garlic, and your favorite herbs. For a simple pasta dish, cook the pasta according to the package instructions. In a separate pan, sauté garlic and add the vegetables until they’re tender. Toss everything together with some olive oil and season to taste.

Don’t forget to make it your own! Experiment with different spices and add proteins like chicken or beans for a more filling meal. Cooking at home not only helps your budget but also encourages creativity in the kitchen.

Setting Financial Goals

In the journey to manage your money better, setting clear financial goals is key. The image shows someone actively writing in a notebook, with the word “Financ” prominently displayed. This simple act symbolizes the beginning of a thoughtful planning process.

When you put pen to paper, you start to define what you want to achieve financially. Would you like to save for a vacation, pay off debt, or build an emergency fund? Identifying these goals can help you stay focused and motivated.

The colorful notes pinned on the wall in the background suggest that visual reminders can enhance your planning. They can serve as prompts for your goals and motivations. Consider creating a vision board or a list of your financial aspirations.

Break your goals down into smaller, achievable steps. For instance, if your goal is to save a certain amount, figure out how much you need to set aside each month. This will make your objectives feel more manageable and less overwhelming.

Lastly, don’t forget to review and adjust your goals regularly. Life changes, and so can your financial situation. Keeping track helps you adapt and stay on the right path.

Buying Used Instead of New

In today’s shopping scene, opting for used items can be a smart choice. Just look at the person in the image, standing in a vibrant store filled with colorful clothing and bags. They seem deep in thought, weighing their options. This moment reflects a growing trend where many are discovering the benefits of buying second-hand.

When you choose used over new, you often find unique pieces that tell a story. Thrift stores and consignment shops are treasure troves of hidden gems. You might stumble upon a vintage jacket or a quirky accessory that stands out from the typical offerings at big retailers.

Additionally, buying used can save you a significant amount of money. Many items retain their quality and functionality, offering you great value without breaking the bank. It’s an easy way to stretch your budget, especially when unexpected expenses pop up.

Plus, shopping second-hand is eco-friendly. By giving new life to pre-loved items, you’re helping reduce waste and promoting sustainability. Every time you choose used, you contribute to a healthier planet.

So next time you feel the urge to splurge on the latest trends, consider visiting a thrift store instead. You might just walk away with something special while keeping your finances in check.

Using Public Transportation

Using public transportation is a smart way to save money and reduce stress. The image shows a person waiting at a bus stop, looking at their phone. This simple act can be a part of a bigger strategy to manage your finances.

When you choose public transit, you often spend less money than you would on gas, parking, or car maintenance. Plus, you can use the time spent on the bus or train to catch up on emails, read a book, or simply relax.

Many cities offer reliable public transport options, making it easier to get to work or run errands without the hassle of driving. It’s also a great way to cut down on your carbon footprint. So next time you need to get somewhere, consider hopping on the bus or train. It’s not just better for your wallet; it can be a little adventure, too!

Finding Free Entertainment Options

One of the best ways to save money is to find fun activities that don’t cost a dime. The photo above beautifully captures a picnic in the park, showing a group of friends enjoying each other’s company. It’s a perfect example of how simple settings can lead to joyful experiences.

Gathering with friends for a picnic is not just enjoyable; it’s also a budget-friendly way to spend time together. You can pack homemade snacks, grab some drinks, and enjoy the great outdoors. Parks often have beautiful scenery, which makes the experience even more delightful.

In addition to picnics, there are other free entertainment options. Many communities offer free events like concerts in the park, outdoor movie nights, or art fairs. Keeping an eye on local bulletin boards or social media can help you find these activities.

Don’t forget about nature! Hiking trails, beaches, and local gardens are usually free to access. They provide a great backdrop for a day out without making you worry about your budget.

So, next time you feel the pinch from your paycheck, consider the free entertainment options available to you. You might be surprised at how much fun you can have without spending a penny!

Understanding Credit Scores

When it comes to managing your finances, understanding your credit score is crucial. The image shows someone analyzing financial data on a computer, which highlights the importance of keeping track of your financial health. Just like the charts and numbers on the screen, your credit score is a reflection of how lenders view your creditworthiness.

Your credit score can determine your ability to borrow money and the interest rates you’ll pay. A higher score usually means lower rates, which can save you money in the long run. The person in the image seems to be diving into their financial details, which is a smart move for anyone wanting to improve their score.

One of the key steps to enhancing your credit score is regularly monitoring it. This allows you to spot any errors or fraudulent activities early on. The data on the screen can serve as a reminder to check your score frequently, as changes can happen based on your payment habits and credit utilization.

Moreover, understanding the factors that influence your credit score can help you make informed decisions. Elements like payment history, credit utilization, and the length of your credit accounts are all vital pieces of the puzzle. So, like the person in the image, take time to analyze your financial habits and make those simple money moves to end the paycheck panic.

Taking Advantage of Community Resources

Community resources can be a lifesaver when you’re trying to manage your finances. Think of places like libraries, community centers, and local workshops. These spots often offer free classes on budgeting, investing, and even job skills that can help you increase your income.

The image above shows a vibrant community space where people gather to work, learn, and connect. Look at all those happy faces! This type of environment encourages collaboration and sharing of ideas, which can be a great asset when you’re trying to improve your financial situation.

Many community resources also provide access to programs that can offer financial assistance. Whether it’s food banks, housing assistance, or utility payment help, these services can ease your financial burden and help you get back on your feet.

Don’t forget to check out local events, too. Many towns host free workshops or seminars that can provide valuable information. Engaging with your community not only helps you learn but can also connect you with people who are in similar situations. Sharing experiences and tips can make a world of difference.

Practicing Mindful Spending

Mindful spending is all about being aware of your financial choices. The image shows a young man in a grocery store, intently studying a piece of paper. This moment captures a crucial part of mindful spending—planning and being deliberate about purchases.

Before heading to the store, it’s helpful to create a list. This man is likely checking his list to ensure he sticks to his budget. Writing down what you need not only keeps you focused but also helps you avoid impulse buys.

As you shop, take your time. Notice the prices and compare them with what you have budgeted. The colorful fruits and vegetables around him remind us of the importance of healthy choices, which can also be budget-friendly.

Practicing mindful spending is more than just saving money; it’s about making choices that align with your values and goals. It’s a simple yet effective way to reduce financial stress.

Planning for Future Expenses

When it comes to managing your finances, planning for future expenses is a key step. The image shows a well-organized notebook filled with financial plans and notes. It reflects the importance of keeping track of your costs and staying ahead of your expenses.

In the notebook, you can see various categories and amounts laid out clearly. This kind of planning helps you visualize where your money is going and what you need to budget for in the coming months. It’s a good reminder that writing things down can make a big difference in how you handle your finances.

Having a dedicated space for your financial planning, like a notebook or a digital app, can streamline the process. It allows you to jot down upcoming bills, savings goals, and even unexpected expenses when they pop up. This proactive approach can help eliminate the anxiety that often comes with managing money.

As you plan your future expenses, consider using a simple format like the one in the image. List your fixed expenses, like rent or utilities, alongside variable ones, like groceries or entertainment. This method makes it easier to spot areas where you can save.

Overall, planning ahead with a clear view of your financial situation can help ease the stress of paycheck panic. It’s about creating a plan that works for you and sticking to it. So grab a notebook, and start writing down your future financial goals today!

Reviewing and Adjusting Your Financial Plan

When it comes to managing your finances, reviewing and adjusting your financial plan can make a big difference. In the image, we see two professionals engaged in a discussion, likely going over important financial documents. This setting highlights the importance of collaboration and thoughtful planning.

Whether you are working with a financial advisor or tackling it on your own, having regular check-ins is essential. It allows you to keep track of your goals, income, and expenses. Just like the two men in the image, having open conversations about your financial situation can lead to better decisions.

Start by examining your budget and any financial goals you set earlier in the year. Are you on track? If things have changed, it’s time to adjust your plan. This could include reallocating funds or cutting unnecessary expenses. Just like the graphs seen on the table, visualizing your progress can help you identify areas for improvement.

Don’t forget to celebrate small wins along the way. Every step you take towards better financial health counts. So, gather your documents, sit down, and have that important conversation—whether it’s with a partner, a friend, or a financial expert. You’ll feel more in control and less anxious about money.

Implementing a Savings Challenge

Have you ever thought about spicing up your savings routine? A savings challenge can add a fun twist to your financial goals. The image above illustrates a colorful savings challenge chart that encourages you to save money consistently. Each color block represents a specific savings goal, making it easy to track your progress.

Using a savings challenge can help you create a target to aim for. By setting small, achievable goals, you can avoid feeling overwhelmed. Take a look at that chart; it’s not just a piece of paper, it’s a roadmap to help you reach your financial milestones.

The chart’s vibrant colors signify different amounts you can save, turning the process into a game. Each time you reach a savings target, you can fill in a block, giving you a visual representation of your success. This can be super motivating!

To start, choose a challenge that feels right for you, whether it’s saving a dollar a day or putting away a set amount each week. The important thing is to make it enjoyable and sustainable. Soon, you’ll see your savings grow, and you won’t feel that paycheck panic quite as much.

Grab your favorite mug, fill it with your favorite drink, and get ready to tackle your savings challenge! With each successful week, you’ll build not just savings but also confidence in managing your finances.

Embracing Minimalism

In a world filled with clutter, embracing minimalism can be a breath of fresh air. The image of a serene living space captures this feeling perfectly. A simple area with a comfortable couch and a cozy throw invites relaxation. The light streaming in through the window creates a warm ambiance, making it an ideal spot to unwind.

The plants in the room add a touch of life, reminding us that we don’t need many things to feel at home. Just a few well-chosen pieces can create a peaceful atmosphere. This minimalist approach not only reduces stress but can also help you save money. By focusing on what truly matters, you cut down on unnecessary purchases.

Consider how a tidy space can reflect your financial goals. When you declutter your home, you might find it easier to declutter your finances as well. Embracing minimalism is about appreciating the essentials, and it can lead to smarter spending habits. So, why not start with your space and see how it influences your wallet?

Tracking Your Financial Progress

In today’s world, keeping an eye on your finances can feel like a daunting task. But guess what? It doesn’t have to be! The image shows someone diligently filling out a financial tracker. This simple act is a step toward better financial health and can really help end that paycheck panic.

The financial tracker has sections for names, goals, and even a space to monitor your progress. By jotting down your goals and tracking your spending, you can gain a clearer picture of where your money is going. This is a vital part of managing your finances effectively, as it encourages you to be proactive instead of reactive.

Using a financial tracker can also make those big financial goals feel a little less overwhelming. Whether you’re saving for a vacation or trying to pay off debt, breaking down your goals into smaller, manageable steps can make a huge difference. Each time you fill out the tracker, you’re not just recording numbers; you’re creating a pathway to financial freedom.

So, grab a pen and start tracking your financial journey! It’s a simple move that can lead to significant changes in how you approach your finances. Remember, every little step counts!

This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Private Policy page.