If you’re tired of living paycheck to paycheck and want to take control of your finances, you’re in the right place. In this list, we’ll dive into ten budget tools that can actually help you keep more cash in your pocket. Whether you need help tracking expenses or managing your savings, these resources are designed to make budgeting easier and more effective for your everyday life.

Budgeting Software with Automated Reports

When it comes to managing your finances, budgeting software can be a real help. The image shows a sleek desktop computer displaying colorful graphs and data. This visual representation highlights how these tools can take the stress out of tracking your spending.

Automated reports are a key feature of many budgeting programs. They gather your financial data and present it in a way that makes it easy to understand. Instead of spending hours sifting through receipts and spreadsheets, you can quickly see where your money is going.

These reports not only save time but also provide insights that can help you make better financial decisions. You’ll get a clearer picture of your spending habits, which can lead to smarter budgeting. So, whether you’re saving for a vacation or just trying to curb unnecessary expenses, this software can guide you.

Embrace the convenience of technology in your budgeting journey. The colorful data on the screen illustrates the importance of visualizing your finances. With the right tools, you can feel more in control of your money and work towards your financial goals.

Expense Tracking Apps for Smart Spending

Managing expenses can feel overwhelming, but expense tracking apps are here to help simplify things. In the image above, we see a smartphone displaying a detailed expense report, surrounded by crumpled receipts. This visual perfectly captures the reality of personal finance—lots of data to sift through and manage.

Expense tracking apps allow you to keep tabs on where your money goes. With graphs and charts at your fingertips, you can easily spot trends in your spending habits. The app shown helps users visualize their expenses, making it easier to identify areas for potential savings.

Using these tools, you can categorize expenses, set budgets, and even receive alerts when you approach your spending limits. This proactive approach to finance can lead to smarter spending decisions and, ultimately, more cash in your pocket.

So next time you look at your pile of receipts, remember that you have the option to go digital. These apps turn your financial chaos into organized insights, helping you make informed choices about your spending.

Investment Simulators for Beginner Investors

When diving into the world of investing, it’s normal to feel a bit overwhelmed. This is where investment simulators come to the rescue. They offer a hands-on way to learn about trading without risking your hard-earned cash. The image here shows a sleek digital interface filled with stock charts and data, which is what you might see when using these simulators.

Investment simulators let you practice trading in a realistic environment. You can see how your choices play out in real-time, which helps you understand market trends and pricing strategies. Whether you’re learning to buy stocks, options, or ETFs, these tools provide valuable practice.

Many simulators even include features like virtual portfolios and analytics tools. This means you can track your performance and adjust your strategies based on what works best for you. With this visual interface, you can familiarize yourself with key metrics and indicators, making your transition to real investing smoother.

Overall, investment simulators are a low-risk way to build your confidence. By experimenting and analyzing your results, you’ll be better prepared when you’re ready to invest your own money. Remember, the more you practice, the more comfortable you’ll become with the investing process!

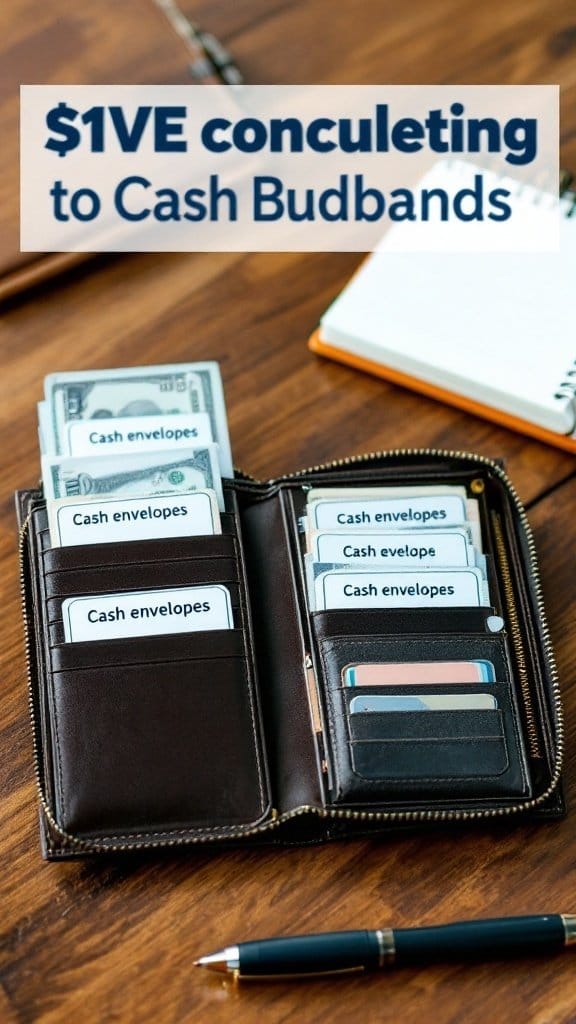

Cash Envelopes System for Controlled Purchases

The cash envelope system is a hands-on way to manage your spending. It involves setting aside cash for specific budget categories. Each envelope represents a different expense, such as groceries, dining out, or entertainment.

In the image, you can see a neat wallet filled with labeled cash envelopes. This setup helps keep your finances organized. By physically separating your cash, you can visually track how much you have left for each category.

Using this system encourages more mindful spending. Once the cash in an envelope is gone, it’s a signal to stop spending in that category for the month. It’s a simple yet effective method to avoid impulse purchases and stick to your budget.

Many people find that handling cash helps them stay more accountable. Plus, it eliminates the temptation to overspend with credit cards. It’s a classic approach that still works well today.

Comparison Tools for Utility and Service Providers

In today’s world, keeping track of your utility bills can be a hassle. But fear not! The image shows a sleek laptop displaying a comparison tool for various utility providers. This can help you make informed decisions about your services.

As you can see, the tool lists several providers along with their prices and services. It allows you to quickly compare options side by side. This is crucial for identifying which services fit your budget best.

Using these comparison tools can lead you to better deals. They save you time and stress by gathering all the information you need in one place. With just a few clicks, you can find the most affordable provider without endless searching.

Whether you’re looking at electricity, water, or internet services, these tools simplify the process. They often display important details like monthly rates and any additional fees. This transparency helps you avoid surprises when the bill arrives.

In summary, using a comparison tool for utility providers is a smart way to keep your expenses in check. By taking advantage of these resources, you can save cash and put that money toward something more enjoyable!

Savings Goal Trackers for Motivation

In today’s world, staying motivated about saving money can be a challenge. This is where savings goal trackers come into play. Picture this: a cozy setting where someone is comfortably holding a tablet that displays their savings progress. The screen showcases a cheerful design with mountains, a smiling character, and colorful graphs. It’s not just visually appealing; it’s also engaging.

The tracker shows two amounts: $1,300 and $1,650. These figures represent the savings goals set by the user. The goal is likely to inspire a sense of achievement as the user watches their progress. Seeing how far they’ve come can be a huge boost!

Having a visual representation of your savings can make the process much more enjoyable. Instead of just thinking about saving, you can actually see your progress. The colorful charts depict various milestones, making it easy to keep track. It’s like turning a boring task into a fun activity.

Using a savings goal tracker helps you stay focused on your financial targets. You can set specific goals for vacations, new gadgets, or even emergency funds. Each time you reach a milestone, it feels rewarding. This kind of positive reinforcement can keep you motivated and on track. Plus, many of these tools are user-friendly and can be customized to fit your unique goals.

Debt Repayment Calculators for Financial Planning

When managing debt, having the right tools can make a world of difference. Debt repayment calculators are great resources that help you visualize your payment plans and understand how long it will take to become debt-free. The image here shows a calculator surrounded by cash, which symbolizes the financial strategies you can adopt.

Using a debt repayment calculator is a straightforward process. You simply enter your total debt amount, interest rates, and monthly payments. The calculator will automatically show you how long it will take to pay off your debt and how much interest you may end up paying. This is a valuable insight that can aid your financial planning.

It’s also helpful to see your repayment options side by side. Many calculators allow you to compare different strategies, such as the snowball method—paying off the smallest debts first—or the avalanche method, where you tackle the debt with the highest interest rate first. This can help you make informed decisions that align with your financial goals.

In essence, these calculators can turn what seems like an overwhelming process into manageable steps. By breaking down your debt repayment plan, you can feel more in control and focused on your financial future.

Coupon and Cash Back Apps for Discounts

In today’s world, saving money is more crucial than ever. With the right tools, you can stretch your budget further. One of the best ways to save is by using coupon and cash back apps. The image above shows a smartphone displaying various apps designed specifically for this purpose.

The phone’s screen is filled with colorful icons, representing different apps that can help you find deals and discounts. Each app offers something unique, whether it’s cashback on grocery purchases or exclusive discounts at your favorite stores. The vibrant colors and easy-to-navigate interface make it inviting and user-friendly.

Next to the phone, you can see some shopping bags and promotional materials. These elements hint at the tangible benefits of using these apps, like saving money on your shopping trips. Imagine walking into a store knowing you have a plan to save. That’s what these apps can help you achieve.

By simply downloading these apps, you can start exploring a world of discounts. Some will require you to scan receipts, while others offer instant discounts at checkout. It’s all about finding what works for you.

So next time you shop, don’t forget to check your phone for those money-saving apps. They can make a difference, turning a regular shopping trip into a savvy saving experience.

Financial Literacy Resources for Budgeting Skills

In today’s fast-paced world, financial literacy is a key skill to master. The image captures a neat workspace with a laptop, a stack of books, and a touch of greenery. This setup perfectly symbolizes the journey of learning about budgeting and finance.

The laptop likely displays budgeting tools or financial advice, making it a practical resource. The books represent various financial literacy resources that can help individuals improve their budgeting skills. It’s all about gathering knowledge and applying it wisely.

Whether you’re diving into personal finance books or exploring online tools, having a dedicated space like this can enhance your learning experience. Remember, budgeting is not just about saving; it’s about understanding where your money goes and making informed decisions.

Expense Sharing Apps for Group Activities

When you’re out with friends or family, keeping track of expenses can get tricky. Whether it’s a dinner, a weekend getaway, or a shared gift, figuring out who owes what can lead to awkward moments. That’s where expense sharing apps come into play!

The image showcases a smartphone displaying an expense sharing app. Here, you can see how easy it is to calculate and split costs among group members. With features that break down each person’s share, everyone stays informed about their part of the bill.

Using an app like this can save you a lot of time and confusion. Just add your group expenses, and the app does the math for you. No more spreadsheets or messy notes! Plus, it keeps things transparent, which is key for a good time.

This particular app shows the total expenses and who owes what. It makes splitting costs feel effortless. You can even track payments, so if someone pays upfront, it’s easy to see who needs to settle up later.

In a world where we love to share experiences, having a tool to manage shared costs is essential. It’s about enjoying each moment without letting finances get in the way.

This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Private Policy page.